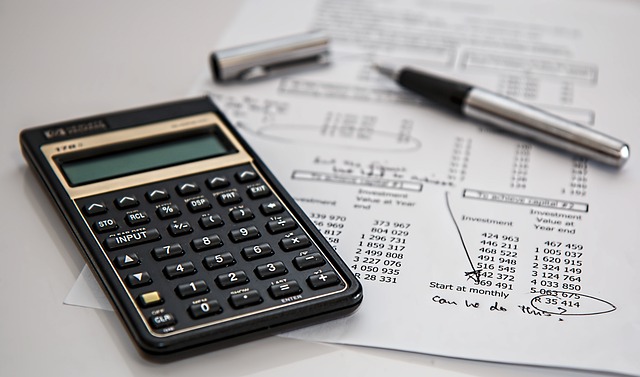

Get Started with Investing: 7 Tips for Beginners

If you’re thinking about investing your money, you might be unsure where to start. The internet and magazines are full of info about investing, which can seem a bit overwhelming at first.

But don’t worry, here are some simple tips to help you kickstart your investment journey. Just remember, it’s always a good idea to chat with a money expert before you put your money into anything.

1. Set Your Goal

When you’re putting your money into something, it’s smart to have a goal. Make sure the time you choose lines up with what you want to do with your cash. This way, you can use your goal like a map to steer your investments in the right direction. It’ll help you stay on track and make sure your money works for you. Whether you’re saving up for your future, a home, school fees, or just making your money grow, having a clear goal is a big help.

2. Handle Risks

If you’re new to this investing stuff, remember to think about how much risk you’re comfortable with. Different things, like your age and your money situation, help you figure out what you should invest in. You can take a quick risk quiz on an app like Cube Wealth to know more about this. Everyone’s different, so pick investments that feel right for you. Some folks want bigger risks for bigger gains, while others like to play it safe to keep their money safe.

3. Start Early

The sooner you start investing, the more money you could make over time. Your money starts growing faster when you start early, so don’t wait. Even if you don’t have a lot of money to start with, that’s okay. You can add more as you make more. The key is to begin while you’re young.

4. Mix It Up

The money world can be pretty up-and-down. To avoid losing lots of cash when things go down, make sure your investments are all different. You can invest in things around the world, just in case things aren’t going great in one place. Even if you’re picking really good stuff, it’s good to have lots of different things. That way, if one part of the market is down, the other parts can help your money stay steady.

5. Go for Quality

Don’t just buy things because they’re cheap. It’s better to spend a bit more on things from good companies. They usually do better in the long run. So before you invest, do some checking and look at the facts.

6. Be Patient

If one of your investments isn’t doing well, don’t panic. Sometimes things turn around later on. The investing world is a bit unpredictable. You can get advice from smart people called Wealth Advisors if you’re not sure what to do.

7. Stay in the Know

It’s smart to keep an eye on how things are going in the money world. Look into the things you’re thinking of investing in and follow what’s happening in the market. But if you’re busy, it’s tough to do all that research.

This is where Cube and other apps come in. They help make things simple and give you advice that’s easy to understand.