Running a small business means wearing many hats. You’re the boss, the marketer, the customer support team—and often the accountant too. That’s why managing finances can quickly become overwhelming, especially when you rely on spreadsheets or outdated desktop software.

In this article, we’ll explore what cloud accounting software is, why it matters, the best features to look for, costs you should expect, and how to choose the right solution for your small business.

Let’s simplify your finances.

What Is Cloud Accounting Software?

Cloud accounting software is an online financial management system that stores your business data securely in the cloud instead of on a local computer.

You access it through:

- A web browser

- A mobile app

- Any device with an internet connection

This means your financial data is always available, automatically updated, and securely backed up.

Unlike traditional accounting software, cloud accounting doesn’t require installations, manual updates, or dedicated hardware.

Why Cloud Accounting Is Perfect for Small Businesses

Small businesses need flexibility, efficiency, and clarity. Cloud accounting delivers all three.

Here’s why it’s becoming the go-to solution.

1. Access Your Finances Anytime, Anywhere

Whether you’re at home, in the office, or travelling, your books are just a login away.

This is especially useful for:

- Remote teams

- Freelancers

- Business owners on the move

2. Real-Time Financial Data

Cloud accounting updates automatically.

You always know:

- Your cash flow

- Outstanding invoices

- Expenses

- Profit and loss

No more guessing. No more outdated reports.

3. Lower Costs Compared to Traditional Software

Most cloud accounting platforms use affordable monthly subscriptions.

This eliminates:

- Large upfront software costs

- Expensive upgrades

- IT maintenance expenses

4. Easy Collaboration With Accountants

You can give your accountant or bookkeeper secure access to your data.

This:

- Saves time

- Reduces errors

- Simplifies tax preparation

No more emailing spreadsheets back and forth.

5. Automatic Backups and Security

Your data is stored securely with:

- Encryption

- Automatic backups

- Multi-factor authentication

This reduces the risk of data loss from hardware failure or theft.

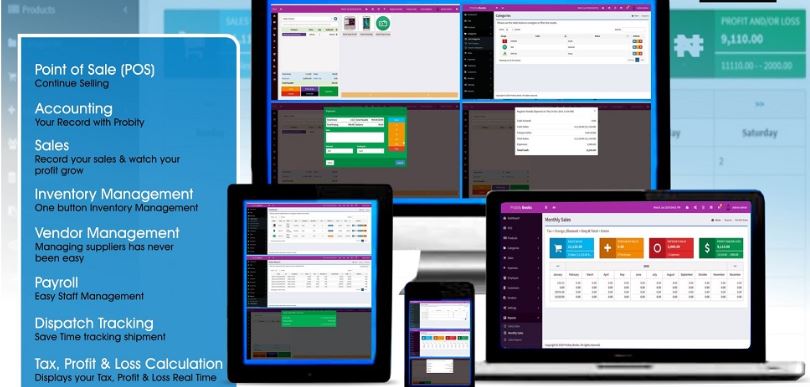

Key Features of Cloud Accounting Software for Small Business

Not all platforms are the same. These features matter most.

Invoicing and Payments

Good cloud accounting software lets you:

- Create professional invoices

- Send them automatically

- Accept online payments

- Track overdue invoices

This helps you get paid faster.

Expense Tracking

Connect your bank accounts and credit cards to:

- Automatically import transactions

- Categorize expenses

- Monitor spending

This saves hours of manual data entry.

Bank Reconciliation

Cloud software matches your transactions with bank records automatically.

This ensures:

- Accuracy

- Clean books

- Fewer errors

Financial Reporting

Generate reports such as:

- Profit and loss statements

- Balance sheets

- Cash flow reports

These reports help you make smarter business decisions.

Tax Preparation Support

Many platforms help with:

- Sales tax tracking

- VAT reporting

- Estimated tax calculations

Some even integrate directly with tax filing tools.

Inventory Management (Optional)

If you sell products, inventory tracking helps you:

- Monitor stock levels

- Track cost of goods sold

- Avoid overselling

Who Should Use Cloud Accounting Software?

Cloud accounting is ideal for:

- Small business owners

- Startups

- Freelancers

- Consultants

- E-commerce sellers

- Service-based businesses

If you want better control over your finances without complexity, cloud accounting is for you.

Cloud Accounting Software vs Traditional Accounting Software

Let’s compare them clearly.

Cloud Accounting Software

- Access anywhere

- Automatic updates

- Lower upfront costs

- Easy collaboration

- Real-time data

Traditional Accounting Software

- Installed on one device

- Manual updates

- Higher upfront costs

- Limited access

- Data stored locally

For most small businesses, cloud accounting is the smarter option.

How Much Does Cloud Accounting Software Cost?

Pricing varies based on features and business size.

Typical Monthly Costs

- Basic plans: $10–$20 per month

- Standard plans: $25–$40 per month

- Advanced plans: $50–$70 per month

Many platforms offer:

- Free trials

- Discounts for annual billing

- Scalable pricing as your business grows

Best Cloud Accounting Software Options for Small Businesses

While availability depends on location, top cloud accounting tools usually share these qualities:

- User-friendly interface

- Reliable customer support

- Strong integrations

- Transparent pricing

- Solid security features

Popular platforms often cater to different needs, from freelancers to growing businesses.

How to Choose the Right Cloud Accounting Software

Choosing the wrong tool can waste time and money. Here’s how to get it right.

Step 1: Identify Your Business Needs

Ask yourself:

- Do I sell products or services?

- Do I need inventory tracking?

- Will I manage payroll?

- Do I work with an accountant?

Your answers narrow down your options.

Step 2: Check Ease of Use

Accounting doesn’t need to be complicated.

Choose software with:

- Simple navigation

- Clear dashboards

- Helpful tutorials

If it feels confusing during the trial, it won’t get better later.

Step 3: Look at Integrations

Your accounting software should connect with:

- Banks

- Payment processors

- CRM tools

- E-commerce platforms

Integrations save time and reduce errors.

Step 4: Consider Scalability

Your business will grow.

Choose software that can grow with you without forcing a full migration later.

Step 5: Review Support and Reviews

Reliable support matters when issues arise.

Look for:

- Live chat or phone support

- Knowledge bases

- Positive user reviews

Benefits of Cloud Accounting for Financial Decision-Making

Cloud accounting doesn’t just track numbers. It improves decisions.

You gain:

- Clear financial visibility

- Better budgeting

- Improved cash flow management

- Faster tax preparation

- Confidence in financial planning

Better data leads to better outcomes.

Common Mistakes Small Businesses Make With Accounting Software

Avoid these mistakes to get the most value.

- Choosing software based only on price

- Ignoring future growth needs

- Not reconciling accounts regularly

- Skipping training or onboarding

- Mixing personal and business finances

Good habits make software work better.

Cloud Accounting and Tax Compliance

Tax compliance becomes easier with cloud accounting.

Benefits include:

- Accurate record-keeping

- Automated tax calculations

- Easier audits

- Cleaner year-end reports

This reduces stress during tax season.

Is Cloud Accounting Software Secure?

Yes—when you choose a reputable provider.

Top platforms use:

- Bank-level encryption

- Secure data centers

- Regular security updates

In many cases, cloud accounting is more secure than local storage.

When Should a Small Business Switch to Cloud Accounting?

You should consider switching if:

- You rely on spreadsheets

- Your current system feels outdated

- You want real-time financial insight

- You collaborate with external accountants

- You’re scaling operations

The sooner you switch, the more time and money you save.

Future of Cloud Accounting for Small Businesses

Cloud accounting continues to evolve with:

- AI-powered insights

- Automated bookkeeping

- Improved forecasting

- Better mobile functionality

Early adopters gain a competitive advantage.

Conclusion

Absolutely.

Cloud accounting software helps small businesses:

- Save time

- Reduce errors

- Improve financial clarity

- Make smarter decisions

- Scale with confidence

It turns accounting from a chore into a powerful business tool.

If you want better control over your finances without complexity, cloud accounting software is one of the smartest investments you can make.