Running a business isn’t cheap. One unexpected expense, a slow-paying client, or a sudden growth opportunity can put serious pressure on your cash flow.

In this article, we’ll break it all down—what online business loans really are, their pros and cons, who they’re best for, and the top lenders you should actually consider.

What Are Online Business Loans?

Online business loans are financing options offered by digital lenders rather than traditional banks or credit unions. You apply online, submit documents electronically, and often receive a decision within hours or days.

Unlike banks, online lenders focus on:

- Speed

- Convenience

- Flexible qualification requirements

They often rely on technology, algorithms, and real-time financial data to assess your business instead of rigid credit models.

That’s why online business loans are especially popular with:

- Small businesses

- Startups

- Freelancers

- E-commerce sellers

- Service-based businesses

But with flexibility comes variety—and not all options are equal.

Common Types of Online Business Loans

Before diving into the pros and cons, it helps to understand the main types of online business loans available today.

Online Term Loans

This is the most straightforward option.

You receive a lump sum and repay it over a fixed period with interest.

Best for:

Growth, expansion, inventory, hiring, or large expenses.

Typical terms:

- 6 months to 5 years

- Fixed weekly or monthly payments

Business Lines of Credit

A flexible credit limit you can draw from as needed.

You only pay interest on what you use.

Best for:

Cash flow gaps, emergencies, recurring expenses.

Short-Term Business Loans

Designed for quick access and fast repayment.

Best for:

Urgent needs or short-term opportunities.

Invoice Financing

You borrow against unpaid invoices.

Best for:

B2B businesses waiting on customer payments.

Equipment Financing

Used to purchase business equipment.

Best for:

Machinery, vehicles, or technology upgrades.

Merchant Cash Advances (MCAs)

You receive cash in exchange for a portion of future sales.

Best for:

High-volume businesses that can handle daily repayments.

This one comes with higher risk, which we’ll cover later.

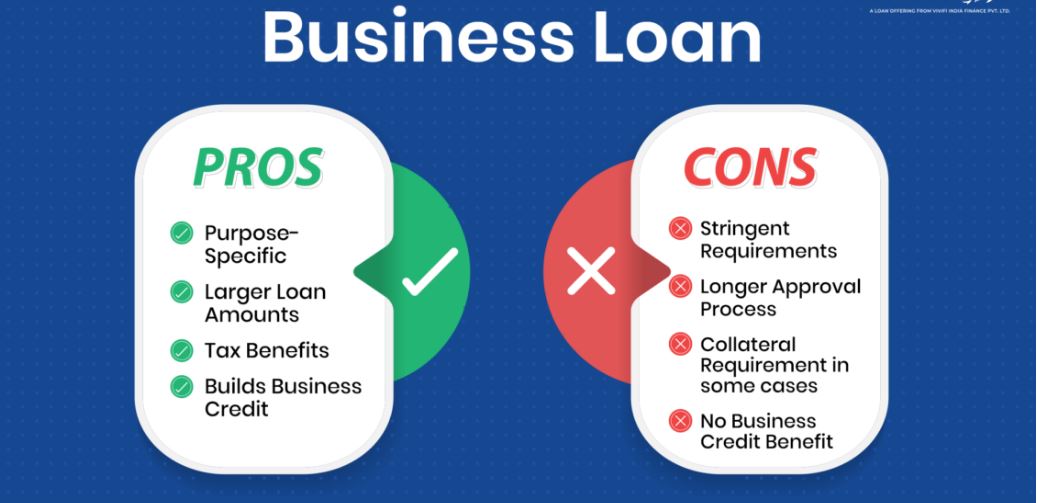

The Pros of Online Business Loans

Let’s start with why so many business owners choose online lenders.

1. Fast Approval and Funding

This is the biggest advantage.

Many online lenders offer:

- Same-day decisions

- Funding within 24–72 hours

When time matters, this speed can be a lifesaver.

2. Simple Application Process

Forget stacks of paperwork.

Most online applications take:

- 10–20 minutes

- Minimal documentation

- No in-person meetings

Everything happens online, on your schedule.

3. Flexible Qualification Requirements

Traditional banks often want:

- Perfect credit

- Years in business

- Large collateral

Online lenders are more flexible.

Many focus on:

- Monthly revenue

- Cash flow

- Business performance

This opens doors for newer and smaller businesses.

4. More Options for Different Needs

Online lending isn’t one-size-fits-all.

You can find loans for:

- Short-term needs

- Long-term growth

- Seasonal businesses

- Low credit borrowers

That variety makes it easier to match funding to your situation.

5. Transparency and Digital Tracking

Most reputable online lenders provide:

- Clear dashboards

- Real-time balance tracking

- Automatic payments

This makes loan management easier and more predictable.

The Cons of Online Business Loans

Now for the reality check.

Online loans are convenient—but they’re not perfect.

1. Higher Interest Rates Than Banks

Speed and flexibility come at a cost.

Online loans usually have:

- Higher interest rates

- Higher APRs

Banks offer lower rates, but only if you qualify and can wait.

2. Shorter Repayment Terms

Many online loans require:

- Weekly payments

- Shorter loan durations

This can strain cash flow if you’re not prepared.

3. Fees Can Add Up

Some lenders charge:

- Origination fees

- Processing fees

- Early repayment penalties

Always read the fine print.

4. Risky Products Exist

Not all online lenders operate ethically.

High-risk options like merchant cash advances can:

- Drain daily revenue

- Lock you into debt cycles

- Cost far more than expected

Knowing what to avoid is just as important as knowing what to choose.

Who Should Consider Online Business Loans?

Online business loans work best for businesses that need:

- Speed

- Flexibility

- Moderate funding amounts

They’re ideal if you:

- Have steady revenue

- Need capital quickly

- Don’t qualify for bank loans

- Want a simple application process

They may not be ideal if:

- You need very large loans

- You can wait months for funding

- You qualify for low-interest bank financing

How to Choose the Right Online Business Loan

Choosing the wrong loan can hurt your business more than help it.

Here’s how to choose wisely.

Know Your Purpose

Ask yourself:

- What is this money for?

- Will it generate or protect revenue?

- How soon will it pay for itself?

Clear goals lead to better loan choices.

Compare APR, Not Just Payments

Weekly payments can look small but hide high costs.

APR shows the true cost of borrowing.

Always ask for it.

Match the Loan Term to Your Cash Flow

Short-term loan for short-term needs.

Long-term loan for long-term investments.

Mismatch creates pressure.

Avoid Daily Repayment If Possible

Daily withdrawals can choke cash flow.

Weekly or monthly payments are safer and easier to manage.

Top Online Business Loan Lenders to Consider

Now let’s talk about lenders that are well-known, reputable, and commonly trusted by small businesses.

Note: Availability and terms vary by business profile.

1. BlueVine

Best for:

Lines of credit and invoice financing.

Why consider them:

- Fast approvals

- Transparent terms

- Strong reputation

2. OnDeck

Best for:

Short-term loans and lines of credit.

Why consider them:

- Quick funding

- Clear pricing

- Useful for established businesses

3. Fundbox

Best for:

Small businesses with limited credit history.

Why consider them:

- Simple applications

- Flexible repayment

- Great for cash flow gaps

4. LendingClub

Best for:

Longer-term business loans.

Why consider them:

- Competitive rates

- Predictable monthly payments

- Bank-style structure5. Kabbage (American Express Business Blueprint)

Best for:

Revenue-based lending and flexible access.

Why consider them:

- Automated approvals

- Strong financial backing

- Easy integration with business accounts

Online Business Loans vs Traditional Bank Loans

Let’s compare them side by side.

Online Loans:

- Fast approval

- Flexible requirements

- Higher rates

- Shorter terms

Bank Loans:

- Lower interest rates

- Longer approval process

- Strict requirements

- More paperwork

Neither is “better.” They serve different needs.

Mistakes to Avoid With Online Business Loans

Many business owners run into trouble because of simple mistakes.

Avoid these:

- Borrowing more than needed

- Ignoring APR and fees

- Accepting daily repayment terms blindly

- Using loans to cover ongoing losses

- Not reading the contract

Loans should support growth—not hide problems.

Smart Ways to Use Online Business Loans

Use online loans for:

- Inventory purchases

- Marketing campaigns

- Equipment upgrades

- Hiring key staff

- Bridging cash flow gaps

Avoid using them for:

- Long-term unprofitable operations

- Personal expenses

- Chronic revenue shortfalls

Conclusion

Online business loans aren’t good or bad by default.

They’re tools.

Used correctly, they can:

- Save time

- Unlock opportunities

- Stabilize operations

- Help your business grow

Used poorly, they can:

- Increase financial stress

- Reduce profits

- Create long-term debt problems

The key is balance.

Understand the terms.

Choose the right lender.

Borrow with a clear purpose.

When you do that, online business loans can be one of the smartest financial tools in your business toolkit.